CAPM: theory, advantages, and disadvantages | F9 Financial Management | ACCA Qualification | Students | ACCA Global

CAPM: theory, advantages, and disadvantages | F9 Financial Management | ACCA Qualification | Students | ACCA Global

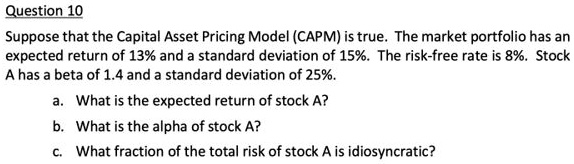

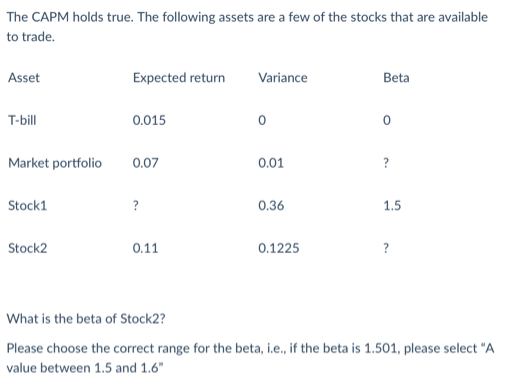

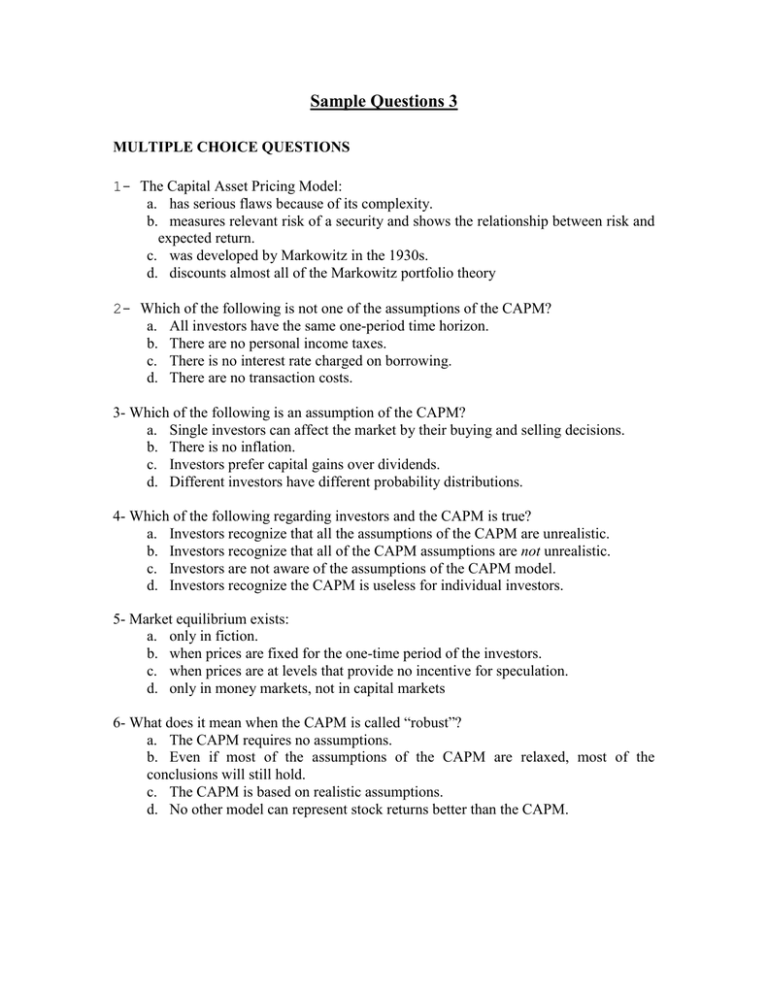

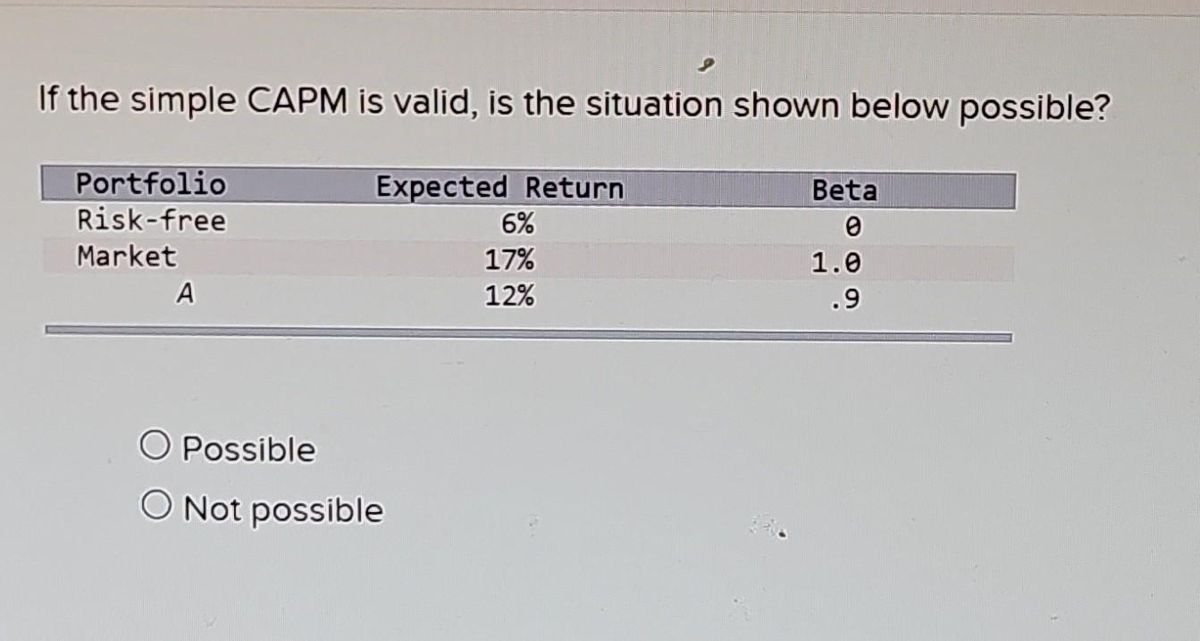

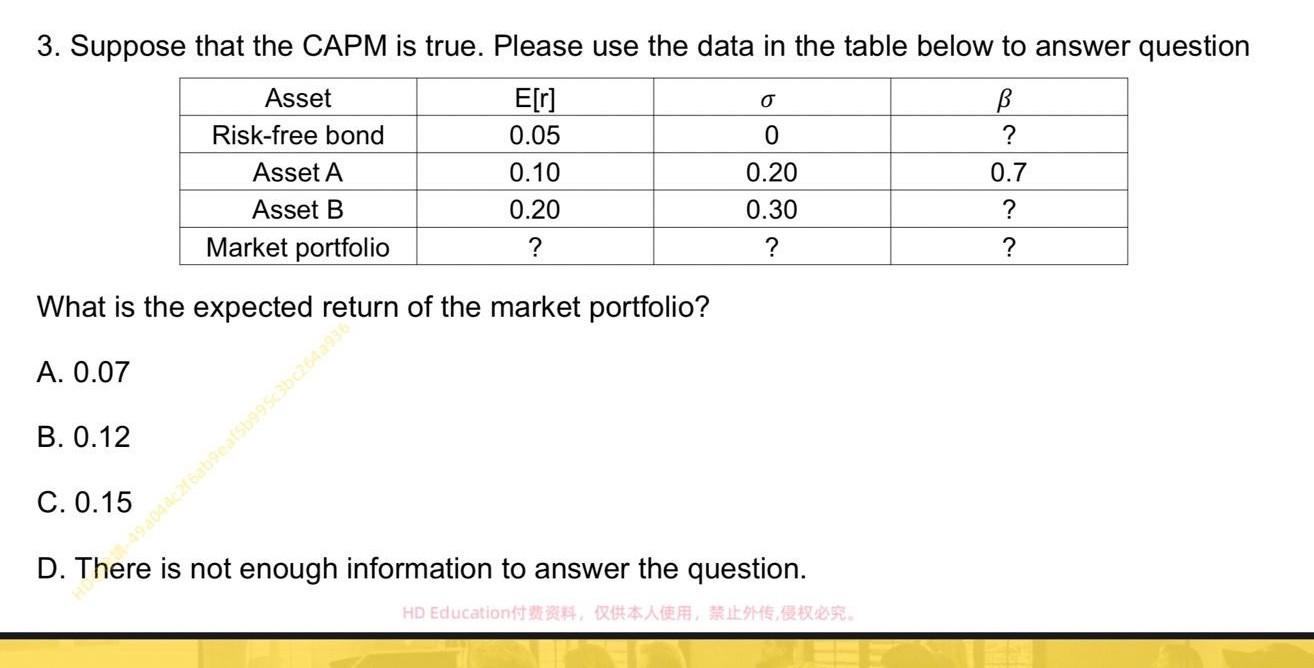

SOLVED: Question 10 Suppose that the Capital Asset Pricing Model(CAPM is true.The market portfolio has an expected return of 13% and a standard deviation of 15%. The risk-free rate is 8%. Stock

:max_bytes(150000):strip_icc()/Term-Definitions_capm-6628d16ef2614d4bbad78324d7439e84.png)

:max_bytes(150000):strip_icc()/GettyImages-1126388682-faaf2b46afd54db78f92b8ed7896de56.jpg)